By using this website, you agree to our Privacy Policy

×

Rubber Extrusions in the UK: Industry Overview and Trends

The UK rubber extrusion market is a vital component of the broader European market, which holds a significant share of 49%. The UK's emphasis on advanced technologies and sustainable manufacturing practices positions it as a leader in quality and environmental responsibility. This is driven by magnetic demand from the automotive, aerospace, and consumer goods sectors, all of which present numerous opportunities for innovation and growth.

In this article, we’ll take a look at the rubber market in more detail, globally, and in the UK, with a particular focus on rubber extrusions.

The Rubber Extrusions Market in the UK

The continuous nature of rubber extrusion makes it more cost-effective, with reduced material wastage, benefiting both production processes and global supply chains. We looked at a report by Fortune Business Insights on the rubber extruder market 2024–2032.

Regionally, Europe dominates the market with a significant share of 49%, and the UK contributes to this with its focus on advanced technologies like 3D printing and hot melt extrusion as well as sustainable manufacturing. The UK's strong regulatory framework, while challenging, advocates high standards that position UK manufacturers as leaders in quality and sustainability within the global market.

Like the global landscape, the UK rubber extrusion market is driven by demand in the automotive, aerospace, and consumer goods sectors, all of which present opportunities for innovation and growth. Compliance with UK-specific regulations such as UK REACH and UKCA marking, along with stringent environmental laws, increases operational costs but also emphasises sustainable practices.

Globally, the rubber extrusion market benefits from the economic efficiency and material wastage reduction inherent in the extrusion process. The COVID-19 pandemic temporarily disrupted production and supply chains, but it also highlighted opportunities for UK manufacturers to reduce dependency on imports, particularly from China. The pandemic reduced production capacities, with many facilities running at 50%, but it also spurred local production.

As part of Europe, the UK shares many of the same market trends, but Brexit has introduced complexities. Post-Brexit, the UK has faced challenges in aligning regulations with the EU, which may affect supply chains and cross-border trade, especially with imports of raw materials and technology transfers. There has been a notable focus in the UK on boosting domestic manufacturing capabilities in rubber extrusion, aiming to rely less on imports, particularly from non-EU countries.

UK-based companies like Primasil Silicones have been acquired by global players, which reflects an interest in integrating UK expertise, especially in areas like medical-grade rubber products.

The Rubber Extrusions Market Internationally

Asia Pacific

This region is the fastest-growing market with a 25% share. Countries like China, Japan, and India are driving the growth due to increasing investments in automotive, HVAC, and advanced extrusion technologies.

North America

The U.S. is a key market driven by the automotive and aerospace sectors. There is significant demand for extruded rubber products in space missions. Local production has also increased to reduce dependency on Chinese imports.

Middle East & Africa and South America

These regions hold smaller market shares but show potential growth due to the increasing use of extruded rubber in oil and gas in the Middle East and manufacturing expansions in South America.

Key Manufacturers and Their Contributions

The rubber market is constantly being developed to fortify rubber extrusion applications and offer more efficient, innovative, and higher-quality solutions. Let’s take a look at some key global developments.

Precision Bespoke Extrusions

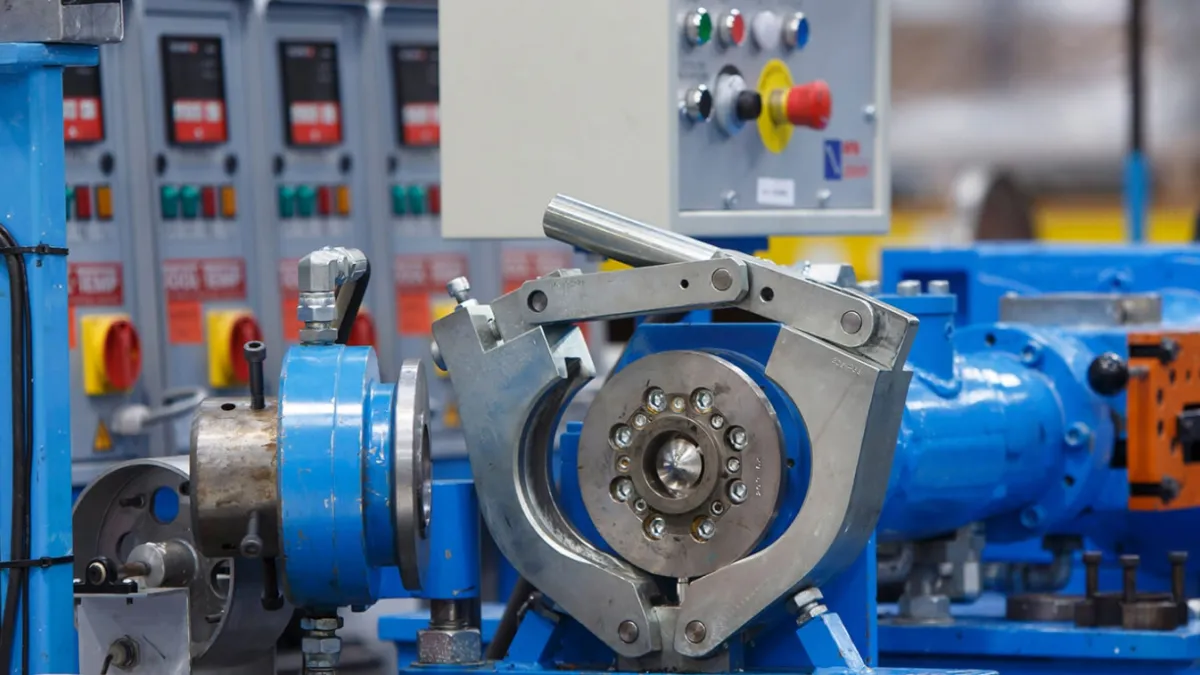

Located in Manchester, Nufox is known for its innovative solutions in rubber extrusion, supplying industries like automotive, construction, and civil engineering. Nufox invests heavily in new technologies and has developed advanced processes that allow for the production of highly durable, versatile rubber components. Nufox’s commitment to sustainability and precision makes the company a standout in the UK market for bespoke rubber extrusion solutions, with products that are engineered to meet both domestic and global demands.

3D Printing Integration

In 2019, Dow unveiled SILASTIC™ 3D 3335 Liquid Silicone Rubber (LSR), a pioneering 3D-printable LSR, enabling the rapid production of high-performing prototypes and custom parts. This innovation reduces the concept-design-testing cycle from months to days and seamlessly transitions prototypes to mass production via injection moulding. Developed with German RepRap GmbH, this material supports fast prototyping, small manufacturing trials, and the creation of customised designs across industries, including automotive and consumer goods. This technology could revolutionise rubber extrusion by enabling faster design iterations and customised extruded profiles, enhancing efficiency and product innovation.

Advanced Material Formulations

The Goodyear Tire & Rubber Company announced a breakthrough with the release of a tyre composed of 70% sustainable materials, marking a large step of progress towards their 2030 goal of producing a 100% sustainable material tyre. This innovation includes 13 key ingredients across nine tyre components which aim at improving performance while reducing environmental impact. Notable advancements include the use of carbon black derived from methane, carbon dioxide, and plant-based oils, soybean oil to maintain rubber pliability, silica from rice husk ash for improved grip and fuel efficiency, and recycled polyester from plastic waste.

Sustainability is also a key consideration in rubber extrusion and advanced material production methods such as this bode well for significantly reducing environmental footprint while maintaining high product performance and quality.

Sustainable Rubber Compounds

Teknor Apex's partnership with UBQ Materials introduces a new line of sustainable thermoplastic elastomers (TPEs) made from UBQ™, a plastic substitute derived from unsorted municipal waste. This innovation reduces the carbon footprint and promotes circularity by diverting waste from landfills. The inclusion of UBQ™ in TPEs offers a versatile, recyclable material suitable for automotive, consumer products, and construction industries. For rubber extrusion, this development means the potential to create flexible, high-performance rubber products with a significantly reduced environmental impact, aligning with increasing market demand for sustainable and eco-friendly materials.

Innovations in Rubber Extrusions Manufacturing

Looking at the wider scope of innovation across the rubber extrusion industry, technology and sustainability take the lead. Here are some examples of the direction innovation is taking.

Aspect of Manufacturing | Innovation |

Advanced Material Formulations |

|

3D Printing Integration |

|

Automated Quality Control Systems |

|

Energy-Efficient Technologies |

|

Digital Twin and Simulation |

|

Smart Manufacturing and Industry 4.0 |

|

Eco-Friendly Manufacturing Practices |

|

Enhanced Extrusion Equipment |

|

Innovation in The Automotive Sector

Driven by the need for better performance and adaptability, the rubber extrusions market continues to expand into automotive applications. Co-extruded sealing systems have furthered the design of weather seals by combining multiple materials in a single extrusion. This allows for the integration of flexible and rigid elements, improving both sealing performance and installation ease. For example, a review on modeling viscoelastic response of vehicle door seal found that automotive weather seals made with EPDM sponge and dense rubber provide superior noise isolation and water resistance.

Hollow profile seals are another innovation, reducing weight while maintaining effective sealing capabilities. This key evolution in materials for automotive weatherstrips means more lightweight profiles are used in vehicle doors and windows, helping to lower overall vehicle weight and improve fuel efficiency without compromising performance.

Conductive rubber extrusions enable the integration of electrical functionality within flexible seals, which is essential for sensors in automatic windows and doors. This technology improves safety by incorporating touch-sensitive features into vehicle components. Self-healing rubber seals also signfiy a promising advancement in automotive safety. These seals can recover from minor damage, extending their lifespan and reducing the need for frequent maintenance, especially in exterior applications.

Outside of safety and basic functionality, rubber extrusions designed for noise, vibration, and harshness (NVH) control are increasingly used in luxury vehicles to reduce cabin noise. Special rubber formulations, such as EPDM sponge, absorb vibrations, ensuring a quieter, more comfortable interior.

The future of automotive rubber extrusion looks towards progressive innovations like smart sealing systems equipped with pressure-sensitive controls automatically adjust their firmness in response to environmental changes. This ensures optimal sealing performance in varying conditions, such as fluctuating air pressure or moisture levels.

Innovation in Aerospace

Key innovations focused on improving performance capabilities spur rubber extrusion on in aerospace aplications. One such development is that of flame-retardant rubber extrusions, which strengthen fire safety in various areas of an aircraft. Materials such as silicone rubber and EPDM are engineered to resist combustion, meeting stringent fire safety standards like the UK CAA (Civil Aviation Authority) CS 25.853 regulation that covers flammability requirements in the specification of large aircraft. These seals are used in critical zones such as the cabin, cargo holds, and engine compartments, helping prevent fire spread. Research continues into rubber materials that can be used to defend against flammability in aerospace, such as this paper by Naumov et al. (2015) which highlights the effectiveness of flame-retardant additives like alumina trihydrate and magnesium hydroxide in improving the fire resistance of elastomers, making them vital for ensuring safety in aerospace applications.

Another innovation is the introduction of static dissipative rubber extrusions, particularly important for preventing static electricity buildup in aircraft fuel systems, where a static discharge could ignite fuel vapours. According to a study on static electricity hazards in aircraft fuel systems, the incorporation of conductive carbon black into rubber formulations significantly reduces the risk of static discharge. This improvement enhances safety during fuel handling and storage, both in-flight and during refuelling operations, by mitigating the risk of sparks in fuel tanks.

Rubber extrusions designed for high-pressure hydraulic systems are another development in the making. These systems, which are critical for controlling flight surfaces and landing gear, require materials that can withstand extreme pressures while resisting fluid degradation.

Challenges and Opportunities in the UK Market

The UK rubber extrusion market faces several challenges that impact its growth and competitiveness. Brexit uncertainties introduced trade barriers and tariffs, complicating supply chains and increasing regulatory compliance costs. The new customs framework and increased red tape under the EU-UK Trade and Cooperation Agreement (TCA) have made trade with the EU more difficult, leading many UK businesses to diversify their supplier portfolios and seek alternatives in the domestic market.

Stricter environmental regulations further burden manufacturers with higher compliance costs related to waste management and emissions standards. The volatility in raw material prices, particularly natural and synthetic rubber, coupled with a heavy reliance on imports, adds to supply chain vulnerabilities.

Despite these challenges, there are some real opportunities before the rubber extrusion market. There is, for instance, a growing demand for eco-friendly and sustainable rubber products, exemplified by previously mentioned innovations like Teknor Apex's use of UBQ™ in TPE compounds. The adoption of automation, AI, and IoT can enhance efficiency and product quality, aligning with Industry 4.0 advancements.

Customised and high-performance products are increasingly sought after in the automotive, aerospace, and healthcare sectors, offering growth potential in niche markets, especially when it comes to bespoke extrusion projects. Expanding into international markets through trade agreements can boost exports, leveraging the UK's reputation for quality. Collaborative efforts with research institutions and participation in government programs can drive technological advancements and innovation. Additionally, government support in the form of funding and grants for R&D and sustainable practices, along with policies promoting domestic manufacturing, can further bolster the industry's growth and global competitiveness.

Regulatory and Environmental Considerations

Here’s a comprehensive table of UK legislation relevant to the manufacture and production of rubber extrusions. It’s important we meet these requirements to produce high-quality products and adhere to our corporate environmental and social responsibilities.

Regulations and Legislation | Detail | Relevance to Rubber Extrusion Industry |

The UK’s national standards body which provides standards for various products including rubber extrusions. | Ensures that rubber extrusion products meet national quality and safety standards for commercial viability. | |

BS 2751 | Specification for acrylonitrile-butadiene rubber (NBR) used in oil and fuel resistance applications. | Critical for producing rubber extrusions that are resistant to oil and fuel, important for automotive applications. |

BS 4443 | Methods of testing for assessing the effects of liquids on vulcanised rubber. | Ensures rubber extrusions can withstand exposure to various liquids, crucial for durability and performance. |

BS 903 | General physical testing methods for rubber. | Standardises testing methods to ensure consistent quality and performance of rubber extrusions. |

BS EN 681-1 | Concerns elastomeric seals and material requirements for pipe joint seals used in water and drainage applications. | Relevant for producing rubber seals used in plumbing and drainage systems, ensuring material suitability and performance. |

Various ASTM standards for rubber properties, such as ASTM D2000 for rubber materials and ASTM D1149 for rubber deterioration. | Provides guidelines for material properties and degradation, essential for ensuring the longevity and reliability of rubber extrusions. | |

International standards for rubber materials and products, like ISO 3302 for tolerances and ISO 37 for tensile testing. | Ensures global compliance and quality of rubber extrusions, facilitating international trade and standardisation. | |

OEM Specifications | Original equipment manufacturer specifications for automotive and aerospace applications. | Ensures that rubber extrusions meet the specific requirements and quality standards of automotive and aerospace manufacturers. |

Commitment to reducing greenhouse gas emissions in line with UK targets. | Encourages the implementation of energy-efficient processes and the use of renewable energy in rubber extrusion manufacturing. | |

Framework for obtaining necessary permits for emissions, waste management, and water discharge. | Ensures compliance with environmental regulations, minimising the environmental impact of rubber extrusion manufacturing. | |

UK government policy promoting the use of recycled materials and designing for longevity and recyclability. | Supports sustainability by encouraging the use of recycled materials and designing products for recyclability. | |

Legal requirements for managing and reducing waste, including recycling. | Promotes waste reduction strategies and recycling of rubber waste, crucial for environmental sustainability. | |

Regulations setting limits for air pollutants, including VOCs. | Requires control of emissions to minimise air pollution from rubber extrusion processes. | |

Framework for managing water resources and preventing contamination. | Ensures proper management of water usage and prevents contamination of water sources in rubber extrusion manufacturing. | |

Encourages sourcing raw materials from sustainable and ethically responsible suppliers. | Ensures natural rubber is sourced sustainably, supporting environmental and social responsibility. | |

Product Stewardship and Lifecycle Assessment (UK Policy) | Evaluates the environmental impact of products throughout their lifecycle. | Encourages the implementation of product stewardship programs to ensure environmental responsibility of rubber extrusion products. |

We’re Nufox, a custom rubber extrusion manufacturer. We create a wide range of rubber extrusion products from profiles to tubing, to gaskets, and all manner of rubber fabrications. Get a quote from us today for a bespoke rubber extrusion project or read our blog for more information and insights on the rubber extrusion industry.

news

Continue reading

Speak to One of Our Experts

Contact UsLEARN

INDUSTRIES

PRODUCTS

BRANDS

GET IN TOUCH

- © 2025 Nufox. All rights reserved |

- Terms & Conditions |

- Privacy Policy |

- Download ISO Certificate | Web Design MadeByShape